Congratulations, mum-to-be (or dad-to-be)!

Whether you’re embarking on the journey of parenthood for the first time or adding to your family, understanding pregnancy insurance is essential for safeguarding your and your baby’s health and well-being.

Mum-to-be (or a concerned, loving husband), here’s everything you need to know about choosing the best pregnancy insurance in Malaysia:

- What is pregnancy insurance?

- When can you purchase pregnancy insurance?

- How does pregnancy insurance work?

- Which company offers the best pregnancy plan?

- Get quotes and compare pregnancy plans. End-to-End Service

What is Pregnancy Insurance?

Pregnancy insurance (also referred to as maternity insurance or prenatal insurance, and some people call it baby insurance) is designed to provide coverage for expectant mothers and their babies during pregnancy and immediately after childbirth.

This insurance provides financial assistance in the form of lump sum payouts or daily benefits to cover additional medical expenses arising from complications during pregnancy or childbirth. In a nutshell, it mainly provides Pregnancy Care Benefit and Baby Care Benefit (in the insurance terms).

🚩 It’s important to note that pregnancy insurance does not cover the cost of delivery or hospitalization bills. Instead, it offers supplementary coverage for complications and congenital conditions that may affect the baby. Examples of congenital conditions include cleft lip, hole in the heart, Cerebral Palsy, Down’s Syndrome, etc.

When Can You Purchase Pregnancy Insurance?

Typically, you can apply for pregnancy insurance between the 13th and 35th weeks of pregnancy. However, eligibility criteria may vary depending on factors such as the mother’s age and health condition, with most insurance companies requiring the mother to be between 16 and 45 years old.

I would rather use the term “apply for pregnancy insurance”, as insurance companies typically have stringent requirements for applications. From my experience handling numerous applications for prenatal insurance, I’ve encountered cases where the application was deferred or rejected. This often occurs when the expectant mother has conditions such as gestational hypertension, gestational diabetes, abnormal placenta, or is underweight or overweight, which insurers consider as risks.

A report from your Obstetrician & Gynaecologist is required to be submitted together with your application when applying for pregnancy insurance.

It’s essential to apply early to ensure comprehensive coverage. By doing so, you can safeguard your health and that of your baby throughout the entire pregnancy. So, if you’re considering getting pregnancy insurance, it’s best to act promptly and secure coverage as soon as possible.

How Does Pregnancy Insurance Work?

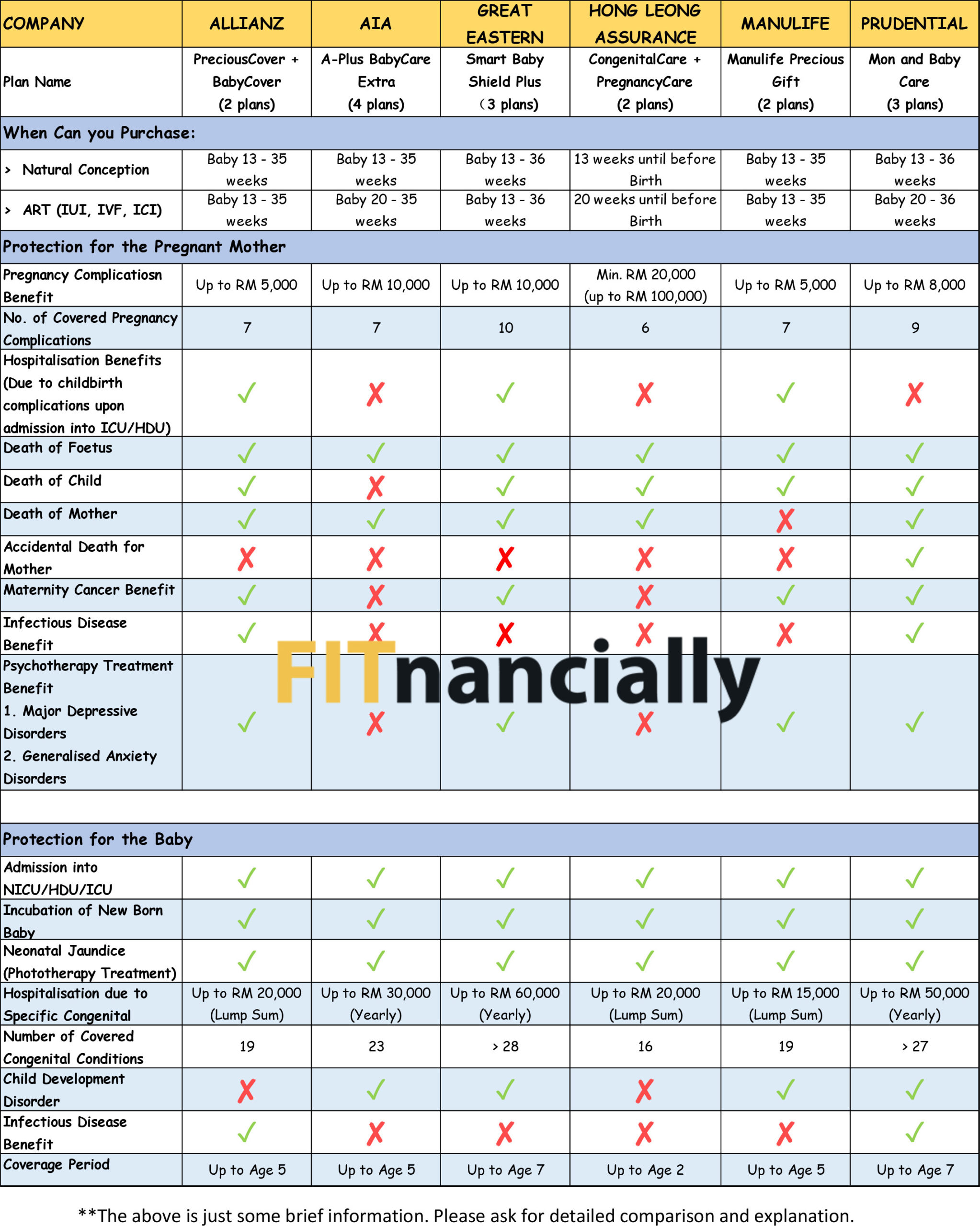

When searching for a pregnancy insurance plan, it’s important to note that coverage may vary depending on the insurance company. Here’s what you can expect to find when exploring your options.

Protection for the mother:

- Death of the Mother: lump sum cash payment in the event of the mother’s death due to complications during pregnancy or childbirth

- Pregnancy Complications: eg. eclampsia, placental abruption, amniotic fluid embolism, etc.

- Hospitalisation Benefits: ICU/HDU Daily Care Benefits for Mother in the event of complications during pregnancy or childbirth

In addition to standard coverage, certain pregnancy insurance plans may include additional benefits for expecting mothers, including psychotherapy treatment for conditions like Major Depressive Disorder and Generalized Anxiety Disorders.

Protection for the baby:

- Hospitalisation due to Congenital Conditions** (the number of the covered conditions varies by the insurance companies)

**Congenital Conditions, also known as birth defects, refer to structural defects, malformations, or functional abnormalities that develop during intrauterine life and may be identified before or at birth, or later in life. Examples of these conditions include cleft lip, hole in the heart, Cerebral Palsy, Down’s Syndrome, and more.

- Neonatal ICU/HDU Care: Daily benefit or reimbursement paid when the child is admitted to Neonatal ICU/HDU

- Incubation of the new born baby

- Neonatal Jaundice requiring Phototherapy Treatment

- Death benefit: Lump sum cash payment upon the death of foetus or child

- Child Development Disorders like Autism Spectrum Disorder, Attention Deficit Hyperactivity Disorder, dyslexia, gross motor delays, and speech delays may be covered by some insurance companies’ plans.

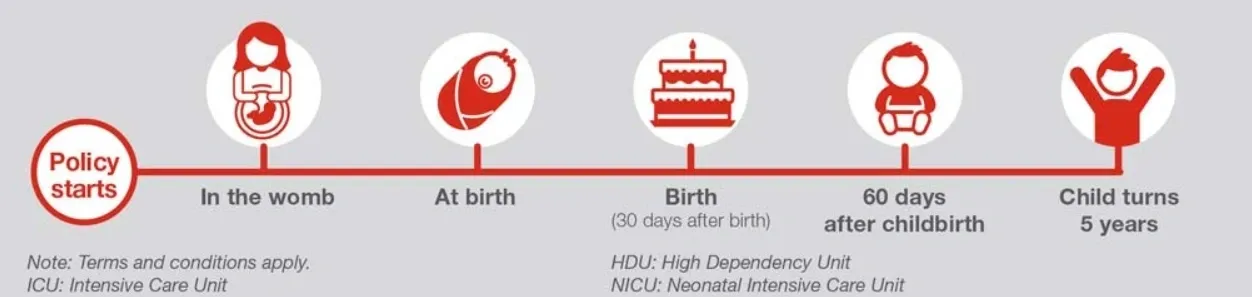

But wait, the coverage doesn’t stop at age 5!

It’s crucial to understand that while many plans offer coverage for your child up to age 5 (or even up to ages 2 or 7, depending on the company), it doesn’t end there! This is because pregnancy insurance typically functions as an add-on rider to a standard investment-linked policy, with life insurance as its primary coverage.

It’s important to note that there are currently NO STANDALONE pregnancy insurance plans available in Malaysia. This means that you cannot purchase pregnancy insurance coverage on its own.

⏩⏩ So, how do you get it?

To secure pregnancy insurance coverage, you need to add it as a rider to a life insurance policy that includes the Protection for the Mother & Baby benefits mentioned earlier. This setup offers flexibility, allowing you to add other riders to your child’s policy, such as a medical card or special illness coverage.

⏩⏩ Now, you might wonder, is it necessary to add these riders to your plan?

While it’s not compulsory, it’s ESSENTIAL to consider because it enables you to secure comprehensive medical coverage for your unborn child. By adding a medical card for your preborn baby, you ensure they are covered from the start.

You might not be aware that insurance companies often decline or postpone medical insurance applications for premature babies until they reach at least 2 years old, and some may even postpone it until age 5. If you only plan to get a medical policy for your child after they are born and your baby is born prematurely, you may struggle to insure them.

✔✔✔ Additionally, for some insurance companies, the premium for purchasing insurance for a baby in the womb isn’t much different from buying it after birth! You only have to pay a few extra months’ premiums, so why not insure your baby before they are born? It’s a small investment that can provide peace of mind and protection for your child’s future.

Which Company Offers The Best Pregnancy Plan?

If you’re considering a pregnancy insurance plan, what’s the next step? Finding the best one, of course!

Awareness of pregnancy insurance has surged in recent years, resulting in several major insurance companies in Malaysia launching more plans. Currently, there are 6 insurance companies offering pregnancy plans to choose from:

- AIA : A-plus Babycare Xtra

- Allianz : Precious Cover

- Great Eastern : Smart Baby Shield

- Prudential : Mom and Baby Care

- Hong Leong Assurance : Pregnancy Care

- Manulife : Manulife Precious Gift

So, what’s the key to choosing the right pregnancy plan? 🧡

When it comes to pregnancy insurance plans, there is no one-size-fits-all solution. Selecting the right pregnancy plan depends on your budget and specific coverage needs.

To find the most suitable plan, you may consider obtaining quotes from different insurance companies to compare the features and benefits of each. Each company has its own set of pros and cons, and you need to prioritize the benefits you require the most.

You can start by shopping around and getting quotes from insurance agents representing different companies. This approach will help you find a plan that meets your needs and fits your budget.

Alternatively, if you prefer not to spend time meeting with multiple insurance agents, you can seek assistance from a Licensed Financial Planner like myself who has access to plans from almost all insurance companies in Malaysia.

This can save you time and help you make a more informed decision.

Get Quotes and Compare Pregnancy Plans. End-to-End Service

As a Licensed Financial Planner specializing in pregnancy insurance, I offer comprehensive services to guide you through the process of selecting the perfect pregnancy insurance plan. My comprehensive service includes:

1️⃣ Obtaining quotations from various insurance companies

2️⃣ Conducting in-depth comparisons of available options

3️⃣ Analyzing and highlighting the pros and cons of each plan

4️⃣ Assisting with policy applications

5️⃣ Managing all policy servicing needs, both now and in the future.

So, sit back, relax, and let me take care of everything for you. 🤗

Fair and Unbiased Guidance

With my comparison service, I ensure my clients receive the best pregnancy insurance plan tailored to their specific needs.

As a busy working parent myself, I understand the importance of time. Meeting with multiple insurance agents to collect quotes and explanations can be a hassle and time-consuming. Moreover, even after investing all that time, the responsibility of comparing the plans still falls on you, as agents typically focus solely on their own company’s offerings.

I firmly believe that everyone deserves unbiased and impartial guidance when selecting an insurance plan. As a Licensed Financial Planner, I prioritize understanding my clients’ unique needs and concerns. From there, I can filter out unsuitable plans and help choose the one that best fits your requirements.

🙋♀️ If you’re looking for guidance on selecting the right pregnancy insurance plan, feel free to contact me. 📞 You can connect with me by clicking the WhatsApp button on the right side below.

With my experience as a parent and years of dealing with pregnancy insurance plans, I know exactly what bothers us as a parent and I’m dedicated to ensuring you and your newborn are well-protected. 🧡

01.

Guaranteed results

Morbi tincidunt enim id blandit sodales. Sed sed libero vehicula, cursus leo eget, tincidunt tortor. Vivamus ligula felis, dictum vitae tincidunt orci.

02.

Perfect implementation

Blandit sodales. Sed sed libero vehicula, cursus leo eget, tincidunt tortor. Vivamus ligula felis, dictum vitae massa ac, tincidunt orci.