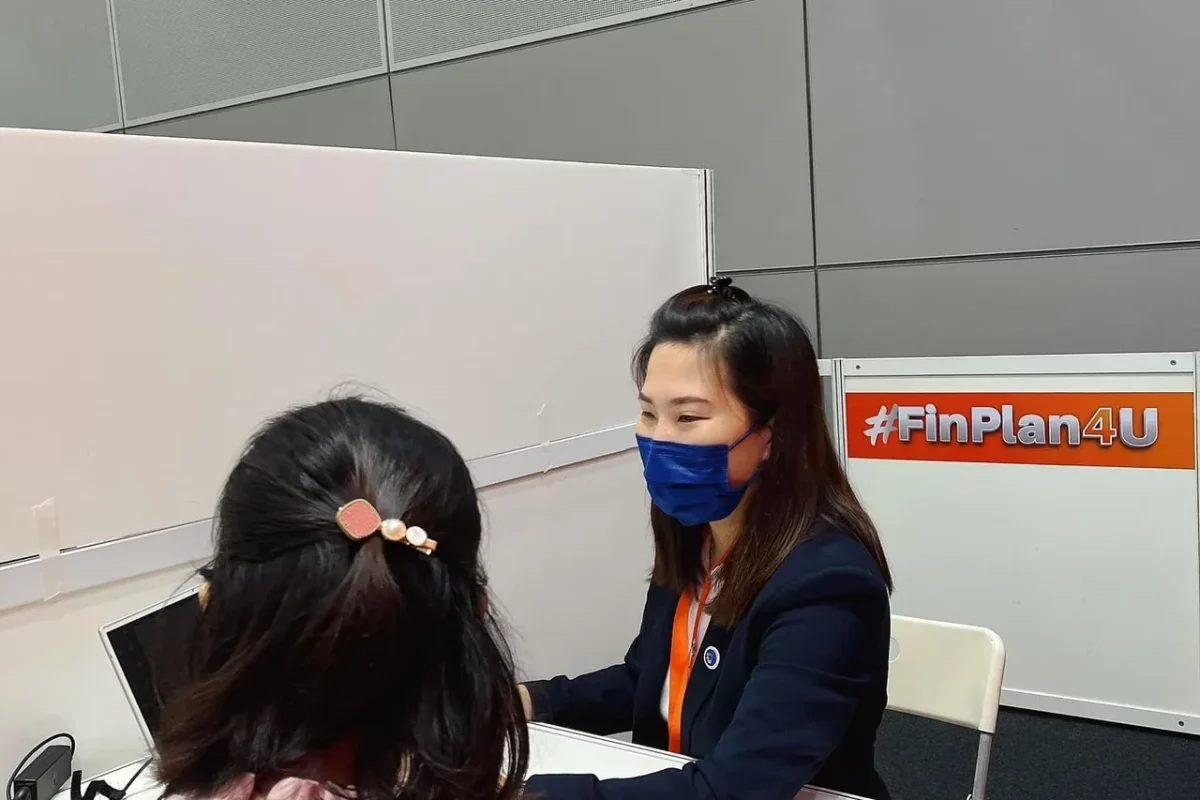

Had the pleasure of participating in #FinPlan4U organized by the Securities Commission Malaysia (“SC”) over the weekend to provide free financial planning advice to the public.

“It feels like getting a number to see the doctor” – said one of the participants as soon as he sat down.

After 45 minutes, the participant said again: “Actually I also suspect I need RM2,000,000 to retire but I’m not sure if what I’m doing now is right. After talking to you, I’m so happy to know that I just need to save & invest an extra RM880 per month then I can retire comfortably in 12 years, even though I would need to postpone my retirement age to 60.”

When I heard him say “I suspect”, I couldn’t help laughing! We also “think” and “suspect” ourselves are down with Covid when we’re uncomfortable, don’t we? But if we haven’t done the test, we’ll be worried all the time. Most people think that financial planning is only needed by those who have financial problems and we thought that since we have a good income and some extra money to save every month, then everything should be all good.

Doing a regular financial review is the same as doing a regular medical examination. It doesn’t necessarily mean that you have to wait until you are ill to do a body check-up, right? Like the participants above, he now realizes that with what he is currently doing, he will not be able to retire at his desired retirement age, but luckily he still has time to do something. If we don’t find out until we are 55 years old, what else can we do? Should we delay retirement until 70 years old? Or downgrade our retirement lifestyle?

The biggest difference between the Financial Health Check and the Body Health Check is that the older you are (usually close to retirement age), the more you need to do the Body Health Check regularly; while the Financial Health Check is best done at a younger age (especially once you have kids and a family) to start planning.

Some of the other questions asked by the participants included:-

- Did I overpay my insurance premium?

- Should I buy a new car or use my existing one?

- Can I use the emergency fund to pay for my wedding?

- I would like to know if I can afford my child’s future higher education fees?

- How much does it cost to hire a financial planner to plan for my future?

- What percentage of income should I invest?

I am glad that I have the opportunity to participate in the #FinPlan4U to do something for the member of the public, allowing them to understand their financial situation and make their goals clearer.

“Planning is bringing the future into the present so that you can do something about it now.”

A licensed and professional financial planner must be competent to assist you in achieving your life goals through a comprehensive financial planning, which involves the detailed review and analysis of all aspects of your financial situation. This includes areas such as:

- Cash flow analysis

- Risk management (insurance planning)

- Retirement planning

- Investment management

- Tax management

- Estate planning

Comprehensive financial planning gives you a complete picture of your current financial situation so you don’t spend money on the wrong financial product or the wrong insurance plan. It allows you to get the most out of your assets or resources and helps you clarify your financial goals and any strategies you have in place to achieve them.

I am happy to support you to achieve your financial goals 🧡 and live a stress free life 🤗

Reach out to me by dropping a 📲 message HERE or book your complimentary 30 minutes consultation to find out how we can work together by filling in your contact details in the “Request A Consultation” box on this website.

01.

Guaranteed results

Morbi tincidunt enim id blandit sodales. Sed sed libero vehicula, cursus leo eget, tincidunt tortor. Vivamus ligula felis, dictum vitae tincidunt orci.

02.

Perfect implementation

Blandit sodales. Sed sed libero vehicula, cursus leo eget, tincidunt tortor. Vivamus ligula felis, dictum vitae massa ac, tincidunt orci.